ELECTRONIC ARTS REPORTS Q1 FY17 FINANCIAL RESULTS

2016-08-02

EA Staff

REDWOOD CITY, CA – August 2, 2016 – Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its first fiscal quarter ended June 30, 2016.

“Q1 was a great quarter for Electronic Arts with amazing engagement in our global communities,” said Chief Executive Officer Andrew Wilson. “EA is leading our industry through innovation, with more of our biggest games powered by Frostbite, breakthrough EA SPORTS titles on console and mobile, and the unstoppable combination of Battlefield 1 and Titanfall 2 coming this holiday. We’re looking forward to connecting more players around the world to each other through the games they love to play.”

“Our digital business drove this quarter, particularly outperformance from FIFA Ultimate Team on console and Star Wars Galaxy of Heroes on mobile,” said Chief Financial Officer Blake Jorgensen. “This success along with the launch of NBA LIVE Mobile gives us great confidence in our ability to operate and add new live services through the year.”

News and ongoing updates regarding EA and our games are available on EA’s blog at www.ea.com/news.

Selected Operating Highlights and Metrics:

· The Battlefield™ franchise, led by Battlefield 4™, had more than 11.5 million unique players during Q1.

· Star Wars™ Battlefront™ had more than 6.6 million unique players in Q1.

· Madden NFL 16 unique players increased more than 20% year-over-year during Q1.

· Madden NFL Mobile had 25% more monthly active players in Q1 over last year.

· Star Wars: Galaxy of Heroes players averaged nearly 2.5 hours of gameplay per day in Q1.

· EA titles shown at EA PLAY and E3 garnered 81 awards, including the Best Action Game for Battlefield 1 and Best Online Multiplayer for Titanfall® 2 from the E3 Game Critics.

· The EA Access subscriber base more than doubled year-over-year in Q1.

Selected Financial Highlights:

· For the quarter, GAAP net revenue of $1.271 billion was above guidance of $1.250 billion. Of the total GAAP net revenue 54%, or $689 million, was digital. Diluted GAAP EPS of $1.40 was above guidance of $1.30.

· For the quarter, change in deferred net revenue was ($589) million of which ($121) million was digital.

· For the quarter, non-GAAP net revenue of $682 million was above guidance of $640 million. Of the total non-GAAP net revenue 83%, or $568 million, was digital. Diluted non-GAAP EPS of $0.07 was above guidance of ($0.05).

· EA repurchased 1.9 million shares in Q1 for $129 million.

(in millions of $, except per share amounts) |

Quarter Ended 6/30/16 |

Quarter Ended 6/30/15

|

GAAP Digital Net Revenue |

$689 |

$623 |

GAAP Packaged Goods and Other Net Revenue |

582 |

580 |

GAAP Total Net Revenue |

$1,271 |

$1,203 |

Digital Change in Deferred Net Revenue Packaged Goods and Other Change in Deferred Net Revenue |

$(121) (468) |

$(91) (419) |

Change in Deferred Net Revenue |

$(589) |

$(510) |

|

|

|

Non-GAAP Digital Net Revenue |

$568 |

$532 |

Non-GAAP Packaged Goods and Other Net Revenue |

114 |

161 |

Non-GAAP Total Net Revenue |

$682 |

$693 |

|

|

|

GAAP Net Income |

$440 |

$442 |

Non-GAAP Net Income |

22 |

49 |

GAAP Diluted Earnings Per Share |

$1.40 |

$1.32 |

Non-GAAP Diluted Earnings Per Share |

0.07 |

0.15 |

|

|

|

Operating Cash Flow |

$(248) |

$(71) |

TTM Financial Highlights:

(in millions) |

TTM Ended 6/30/16 |

TTM Ended 6/30/15

|

GAAP Digital Net Revenue |

$2,475 |

$2,286 |

GAAP Packaged Goods and Other Net Revenue |

1,989 |

2,218 |

GAAP Total Net Revenue |

$4,464 |

$4,504 |

Digital Change in Deferred Net Revenue Packaged Goods and Other Change in Deferred Net Revenue |

$92 (1) |

$(6) (261) |

Change in Deferred Net Revenue |

$91 |

$(267) |

|

|

|

Non-GAAP Digital Net Revenue |

$2,567 |

$2,280 |

Non-GAAP Packaged Goods and Other Net Revenue |

1,988 |

1,957 |

Non-GAAP Total Net Revenue |

$4,555 |

$4,237 |

|

|

|

GAAP Net Income |

$1,154 |

$982 |

Non-GAAP Net Income |

991 |

794 |

|

|

|

Operating Cash Flow |

$1,046 |

$992 |

|

|

|

Value of Shares Repurchased |

$1,015 |

$419 |

Number of Shares Repurchased |

15 |

9 |

|

|

|

Please note that this is the final quarter that EA will be reporting any non-GAAP measure that adjusts for deferred revenue. EA will report GAAP financial measures and will also separately report financial data that EA management uses internally to calculate adjustments to its GAAP financial measures so that investors may be able to calculate measures comparable to our historical non-GAAP financial measures. For more information regarding this change to external reporting, please refer to the July 19, 2016 investor call transcript, FAQ document and financial model available at http://investor.ea.com.

Business Outlook as of August 2, 2016

Please note that this is the final quarter that EA will be reporting any non-GAAP measure that adjusts for deferred revenue. EA will report GAAP financial measures and will also separately report financial data that EA management uses internally to calculate adjustments to its GAAP financial measures so that investors may be able to calculate measures comparable to our historical non-GAAP financial measures. For more information regarding this change to external reporting, please refer to the July 19, 2016 investor call transcript, FAQ document and financial model available at http://investor.ea.com.

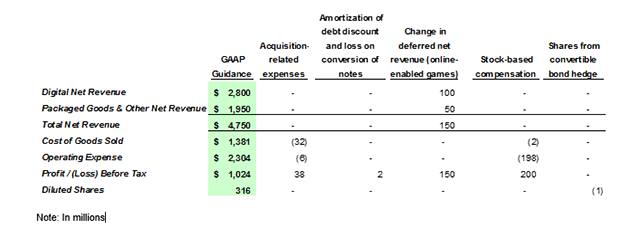

Fiscal Year 2017 Expectations – Ending March 31, 2017

· GAAP net revenue is expected to be approximately $4.750 billion.

· Change in deferred net revenue is expect to be approximately $150 million.

· GAAP net income is expected to be approximately $809 million.

· GAAP diluted earnings per share is expected to be approximately $2.56.

· Operating cash flow is expected to be approximately $1.300 billion.

· The Company estimates a share count of 316 million for purposes of calculating fiscal year 2017 GAAP diluted earnings per share.

In addition, while EA no longer provides expectations on non-GAAP financial performance measures, the following outlook for GAAP-based financial data and a long-term tax rate of 21% are used internally by EA to adjust our GAAP expectations to assess EA’s operating results and plan for future periods:

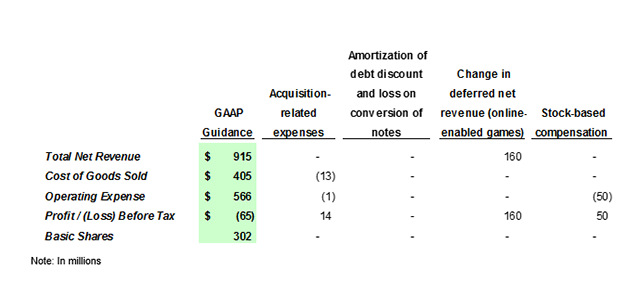

Second Quarter Fiscal Year 2017 Expectations – Ending September 30, 2016

· GAAP net revenue is expected to be approximately $915 million.

· Change in deferred net revenue is expected to be approximately $160 million.

· GAAP net loss is expected to be approximately ($51) million.

· GAAP loss per share is expected to be approximately ($0.17).

· The Company estimates a GAAP basic and diluted share count of 302 million shares due to a forecasted net loss. If the Company reports net income instead of a net loss, diluted share count for calculating diluted earnings per share would be 315 million shares.

In addition, while EA no longer provides expectations on non-GAAP financial performance measures, the following outlook for GAAP-based financial data and a long-term tax rate of 21% are used internally by EA to adjust our GAAP expectations to assess EA’s operating results and plan for future periods:

Conference Call and Supporting Documents

Electronic Arts will host a conference call on August 2, 2016 at 2:00 pm PT (5:00 pm ET) to review its results for the first quarter ended June 30, 2016 and its outlook for the future. During the course of the call, Electronic Arts may disclose material developments affecting its business and/or financial performance. Listeners may access the conference call live through the following dial-in number 844-215-4106 (domestic) or 918-534-8313 (international), using the password “EA” or via webcast at http://ir.ea.com.

EA will also post a slide presentation that accompanies the call at http://ir.ea.com.

A dial-in replay of the conference call will be available until August 16, 2016 at 855-859-2056 (domestic) or 404-537-3406 (international). An audio webcast replay of the conference call will be available for one year at http://ir.ea.com.

Non-GAAP Financial Measures

Please note that this is the final quarter that EA will be reporting any non-GAAP measure that adjusts for deferred revenue. EA will continue to report GAAP financial measures and will also separately report financial data that EA management uses internally to calculate adjustments to its GAAP financial measures so that investors may be able to calculate measures comparable to our historical non-GAAP financial measures. For more information regarding this change to external reporting, please refer to the July 19, 2016 investor call transcript, FAQ document and financial model available at http://investor.ea.com.

To supplement the Company’s unaudited condensed consolidated financial statements presented in accordance with GAAP, Electronic Arts uses certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations as determined in accordance with GAAP. The non-GAAP financial measures used by Electronic Arts include: non-GAAP net revenue, non-GAAP gross profit, non-GAAP operating income, non-GAAP net income, non-GAAP diluted earnings per share and non-GAAP diluted shares. These non-GAAP financial measures are adjusted for the items referenced below, as applicable in a given reporting period, from the Company’s unaudited condensed consolidated statements of operations. The adjustments to the non-GAAP financial measures exclude the following items (other than shares from the Convertible Bond Hedge, which are included):

· Acquisition-related expenses

· Amortization of debt discount and loss on conversion of notes

· Change in deferred net revenue (online-enabled games)

· Income tax adjustments

· Shares from Convertible Bond Hedge

· Stock-based compensation

Electronic Arts’ management uses these non-GAAP financial measures in assessing the Company’s operating results both as a consolidated entity and at the business unit level, as well as when planning, forecasting and analyzing future periods. The Company’s management team is evaluated on the basis of non-GAAP financial measures and these measures also facilitate comparisons of the Company’s performance to prior periods.

In addition to the reasons stated above, which are generally applicable to each of the items Electronic Arts excludes from its non-GAAP financial measures, the Company believes it is appropriate to exclude certain items for the following reasons:

Acquisition-Related Expenses. GAAP requires expenses to be recognized for various types of events associated with a business acquisition. These events include expensing acquired intangible assets, including acquired in-process technology, post-closing adjustments associated with changes in the estimated amount of contingent consideration to be paid in an acquisition, and the impairment of accounting goodwill created as a result of an acquisition when future events indicate there has been a decline in its value. When analyzing the operating performance of an acquired entity, Electronic Arts’ management focuses on the total return provided by the investment (i.e., operating profit generated from the acquired entity as compared to the purchase price paid including the final amounts paid for contingent consideration) without taking into consideration any allocations made for accounting purposes. When analyzing the operating performance of an acquisition in subsequent periods, the Company’s management excludes the GAAP impact of any adjustments to the fair value of these acquisition-related balances to its financial results.

Amortization of Debt Discount and Loss on Conversion of Notes. In July 2011, EA issued $632.5 million of 0.75% convertible senior notes in a private placement offering (the “Convertible Notes”). Under GAAP, certain convertible debt instruments that may be settled in cash on conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. Accordingly, for GAAP purposes, we amortize as a debt discount an amount equal to the fair value of the conversion option on the Convertible Notes over their term. The debt discount is classified as interest expense. Upon settlement of our Convertible Notes, we attribute the fair value of the consideration transferred to the liability and equity components. The difference between the fair value of the consideration attributed to the liability component and the carrying value of the liability is recorded as a non-cash loss in the statement of the operations. Electronic Arts’ management excludes the effect of the amortization of debt discount and the non-cash loss on the early conversion of debt in its non-GAAP financial measures. The Convertible Notes matured on July 15, 2016 and have been repaid in full.

Change in Deferred Net Revenue (Online-enabled Games). The majority of our software games can be connected to the Internet whereby a consumer may be able to download unspecified content or updates on a when-and-if-available basis (“unspecified updates”) for use with the original game software. In addition, we may also offer an online matchmaking service that permits consumers to play against each other via the Internet. GAAP requires us to account for the consumer’s right to receive unspecified updates or the matchmaking service for no additional fee as a “bundled” sale, or multiple-element arrangement. Electronic Arts is not able to objectively determine the fair value of these unspecified updates or online service included in certain of its online-enabled games. As a result, the Company recognizes the revenue from the sale of these online-enabled games on a straight-line basis over the estimated offering period. Specifically, an increase in change in deferred net revenue on the balance sheet during the period would result in lower GAAP net revenue as compared to non-GAAP net revenue and a (decrease) in change in deferred net revenue on the balance sheet during the period would result in a higher GAAP net revenue compared to non-GAAP net revenue. Electronic Arts’ management excludes the impact of the change in deferred net revenue related to online-enabled games in its non-GAAP financial measures for the reasons stated above and also to facilitate an understanding of our operations because the related costs of revenue are generally expensed as incurred instead of deferred and recognized ratably. The difference between the change in deferred net revenue (online-enabled games) from the balance sheet does not always equal the change in deferred net revenue (online-enabled games) in the GAAP financial measures due to the net impact of unrecognized gains/losses on cash flow hedges.

Income Tax Adjustments. The Company uses a fixed, long-term projected tax rate internally to evaluate its operating performance, to forecast, plan and analyze future periods, and to assess the performance of its management team. Accordingly, the Company applies the same tax rate to its non-GAAP financial results. During fiscal year 2017, the Company applies a tax rate of 21 percent to its non-GAAP financial results. During fiscal year 2016, the Company applied a tax rate of 22 percent.

Shares from Convertible Bond Hedge. The Convertible Notes were issued with an initial conversion price of approximately $31.74 per share. When the quarterly average trading price of EA’s common stock is above $31.74 per share, the potential conversion of the Convertible Notes has a dilutive impact on the Company’s earnings per share. At the time they were issued, the Company entered into convertible note hedge transactions (the “Convertible Bond Hedge”) to offset the dilutive effect of the Convertible Notes. The Company includes the anti-dilutive effect of the Convertible Bond Hedge in determining its non-GAAP dilutive shares. In connection with the maturity of the Convertible Notes, the Convertible Bond Hedges have been settled.

Stock-Based Compensation. When evaluating the performance of its individual business units, the Company does not consider stock-based compensation charges. Likewise, the Company’s management teams exclude stock-based compensation expense from their short and long-term operating plans. In contrast, the Company’s management teams are held accountable for cash-based compensation and such amounts are included in their operating plans. Further, when considering the impact of equity award grants, Electronic Arts places a greater emphasis on overall shareholder dilution rather than the accounting charges associated with such grants.

In the financial tables below, Electronic Arts has provided a reconciliation of the most comparable GAAP financial measures to non-GAAP financial measures used in this press release.

Forward-Looking Statements

Some statements set forth in this release, including the information relating to EA’s fiscal 2017 guidance information under the heading “Business Outlook,” and changes to EA’s financial reporting contain forward-looking statements that are subject to change. Statements including words such as “anticipate,” “believe,” “estimate” or “expect” and statements in the future tense are forward-looking statements. These forward-looking statements are preliminary estimates and expectations based on current information and are subject to business and economic risks and uncertainties that could cause actual events or actual future results to differ materially from the expectations set forth in the forward-looking statements.

Some of the factors which could cause the Company’s results to differ materially from its expectations include the following: sales of the Company’s titles; the Company’s ability to manage expenses; the competition in the interactive entertainment industry; the effectiveness of the Company’s sales and marketing programs; timely development and release of Electronic Arts’ products; the Company’s ability to realize the anticipated benefits of acquisitions; the consumer demand for, and the availability of an adequate supply of console hardware units; the Company’s ability to predict consumer preferences among competing platforms; the Company’s ability to service and support digital product offerings, including managing online security; general economic conditions; and other factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2016.

These forward-looking statements are current as of August 2, 2016. Electronic Arts assumes no obligation and does not intend to update these forward-looking statements. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Electronic Arts.

While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2016. Electronic Arts assumes no obligation and does not intend to update these estimates prior to filing its Form 10-Q for the fiscal quarter ended June 30, 2016.

About Electronic Arts

Electronic Arts (NASDAQ: EA) is a global leader in digital interactive entertainment. The Company delivers games, content and online services for Internet-connected consoles, personal computers, mobile phones and tablets. EA has more than 300 million registered players around the world.

In fiscal year 2016, EA posted GAAP net revenue of $4.4 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality blockbuster brands such as The Sims™, Madden NFL, EA SPORTS™ FIFA, Battlefield™, Dragon Age™ and Plants vs. Zombies™. More information about EA is available at www.ea.com/news.

EA SPORTS, Battlefield, Battlefield 4, The Sims, Dragon Age, Ultimate Team and Plants vs. Zombies are trademarks of Electronic Arts Inc. and its subsidiaries. STAR WARS © & TM 2015 Lucasfilm Ltd. All rights reserved. Titanfall is a trademark of Respawn Entertainment, LLC. John Madden, NFL, NBA and FIFA are the property of their respective owners and used with permission.

For additional information, please contact:

Chris Evenden |

John Reseburg |

Vice President, Investor Relations |

Vice President, Corporate Communications |

650-628-0255 |

650-628-3601 |

|

|