Electronic Arts Reports Q1 & FY26 Results

EA Delivers Strong Q1 with Broad-Based Portfolio Performance; New Battlefield 6 Reveal Just Days Away

July 29, 2025

REDWOOD CITY, CA – July 29, 2025 – (NASDAQ: EA) today announced preliminary financial results for its first quarter ended June 30, 2025.

“We delivered a strong start to FY26, outperforming expectations ahead of what will be the most exciting launch slate in EA’s history,” said Andrew Wilson, CEO of Electronic Arts. “From deepening player engagement in EA SPORTS to gearing up for Battlefield 6 and skate., we’re scaling our global communities and continuing to shape the future of interactive entertainment.”

“We exceeded the high end of our guidance in Q1 highlighting the resilience of our live services and the breadth of our portfolio,” said Stuart Canfield, CFO of Electronic Arts. “With strong fundamentals and a robust pipeline ahead, we remain confident in our full-year guidance and long-term margin framework.”

Selected Operating Highlights and Metrics

- Net bookings1 for the quarter totaled $1.298 billion, exceeding the high end of the guidance range of $1.275 billion.

- Q1 performance saw better-than-expected contributions from many areas in our portfolio, including EA SPORTS, Apex Legends, and catalog.

- Global Football delivered year-over-year growth in net bookings, highlighted by a record quarter in FC Mobile net bookings.

- EA SPORTS F1 25 delivered strong year-over-year net bookings growth, supported by an enhanced gameplay experience, including real-world integration with “F1 The Movie”.

Selected Financial Highlights and Metrics

- Net revenue was $1.671 billion for the quarter.

- Net cash provided by operating activities was $17 million for the quarter and $1.976 billion for the trailing twelve months.

- EA repurchased 3.0 million shares for $375 million during the quarter, bringing the total for the trailing twelve months to 17.8 million shares for $2.500 billion.

Dividend

EA has declared a quarterly cash dividend of $0.19 per share of the Company’s common stock. The dividend is payable on September 17, 2025 to stockholders of record as of the close of business on August 27, 2025.

Business Outlook as of May 6, 2025

Fiscal Year 2026 Expectations

Our outlook for fiscal year 2026 provided on May 6, 2025 remains unchanged.

- Net bookings is expected to be approximately $7.600 billion to $8.000 billion.

- Net revenue is expected to be approximately $7.100 billion to $7.500 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately $500 million.

- GAAP operating expenses are expected to be approximately $4.470 billion to $4.570 billion.

- Net income is expected to be approximately $795 million to $974 million.

- Diluted earnings per share is expected to be approximately $3.09 to $3.79.

- Operating cash flow is expected to be approximately $2.200 billion to $2.400 billion.

- The Company estimates a share count of 257 million for purposes of calculating diluted earnings per share.

- The Company intends to return at least 80% of free cash flow with stock repurchases and dividends through fiscal year 2027.

Q2 Fiscal Year 2026 Expectations – Ending September 30, 2025

- Net bookings is expected to be approximately $1.800 billion to $1.900 billion.

- The Company expects a more normalized curve for College Football full game sales, partially offset by the launch of Madden NFL 26. Expectations are that early momentum in Apex Legends and catalog continues.

- This guidance includes a four-point year-over-year headwind related to phasing of the EA SPORTS FC 26 Ultimate Edition content, which will largely be recognized in Q3.

- Net revenue is expected to be approximately $1.750 billion to $1.850 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately $50 million.

- GAAP operating expenses are expected to be approximately $1.215 billion to $1.235 billion.

- Year-over-year growth in expenses is largely driven by marketing related to upcoming launches, notably Battlefield 6.

- Net income is expected to be approximately $73 million to $117 million.

- Diluted earnings per share is expected to be approximately $0.29 to $0.46.

- The Company estimates a share count of 253 million for purposes of calculating diluted earnings per share.

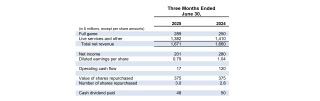

Quarterly Financial Highlights

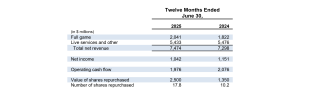

Trailing Twelve Months Financial Highlights

Operating Metric

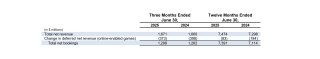

The following is a calculation of our total net bookings for the periods presented:

Conference Call and Supporting Documents

Electronic Arts will host a conference call on July 29, 2025 at 2:00 pm PT (5:00 pm ET) to review its results for the first fiscal quarter ended June 30, 2025 and its outlook for the future. During the course of the call, Electronic Arts may disclose material developments affecting its business and/or financial performance. Listeners may access the conference call live through the following dial-in number (855) 761-5600 (domestic) or (646) 307-1097 (international), using the conference code 5939891 or via webcast at EA’s IR Website at http://ir.ea.com.

EA has posted a slide presentation with a financial model of EA’s historical results and guidance on EA’s IR Website. EA will also post the prepared remarks and a transcript from the conference call on EA’s IR Website.

A dial-in replay of the conference call will be available until August 12, 2025 at (800) 770-2030 (domestic) or (609) 800-9099 (international) using conference code 5939891. An audio webcast replay of the conference call will be available for one year on EA’s IR Website.

Forward-Looking Statements

Some statements set forth in this release, including the information relating to EA’s expectations under the heading “Business Outlook as of July 29, 2025” and other information regarding EA's expectations contain forward-looking statements that are subject to change. Statements including words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “plan,” “predict,” “seek,” “goal,” “will,” “may,” “likely,” “should,” “could” (and the negative of any of these terms), “future” and similar expressions also identify forward-looking statements. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Our actual results could differ materially from those discussed in the forward-looking statements.

Some of the factors which could cause the Company’s results to differ materially from its expectations include the following: sales of the Company’s products and services; the Company’s ability to develop and support digital products and services, including managing online security and privacy; outages of our products, services and technological infrastructure; the Company’s ability to manage expenses; the competition in the interactive entertainment industry; governmental regulations; the effectiveness of the Company’s sales and marketing programs; timely development and release of the Company’s products and services; the Company’s ability to realize the anticipated benefits of, and integrate, acquisitions; the consumer demand for, and the availability of an adequate supply of console hardware units; the Company’s ability to predict consumer preferences and trends; the Company’s ability to develop and implement new technology; foreign currency exchange rate fluctuations; economic and geopolitical conditions; changes in our tax rates or tax laws; and other factors described in Part I, Item 1A of Electronic Arts’ latest Annual Report on Form 10-K under the heading “Risk Factors”, as well as in other documents we have filed with the Securities and Exchange Commission.

These forward-looking statements are current as of July 29, 2025. Electronic Arts assumes no obligation to revise or update any forward-looking statement, except as required by law. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Electronic Arts.

While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Form 10-Q for the fiscal quarter ended June 30, 2025. Electronic Arts assumes no obligation and does not intend to update these estimates prior to filing its Form 10-Q for the fiscal quarter ended June 30, 2025.

About Electronic Arts

Electronic Arts (NASDAQ: EA) is a global leader in digital interactive entertainment. The Company develops and delivers games, content and online services for Internet-connected consoles, mobile devices and personal computers.

In fiscal year 2025, EA posted GAAP net revenue of approximately $7.5 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality brands such as EA SPORTS FC™, Battlefield™, Apex Legends™, The Sims™, EA SPORTS™ Madden NFL, EA SPORTS™ College Football, Need for Speed™, Dragon Age™, Titanfall™, Plants vs. Zombies™ and EA SPORTS F1®. More information about EA is available at www.ea.com/news.

EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Dragon Age, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, and F1 are the property of their respective owners and used with permission.

For additional information, please contact:

Andrew Uerkwitz

Vice President, Investor Relations

650-674-7191

auerkwitz@ea.com

Justin Higgs

Vice President, Corporate Communications

925-502-9253

jhiggs@ea.com

1 Net bookings is defined as the net amount of products and services sold digitally or sold-in physically in the period. Net bookings is calculated by adding total net revenue to the change in deferred net revenue for online-enabled games.